Revised Stage 3 personal tax cuts now law

From 1 July 2024, the revised Stage 3 tax cuts will:

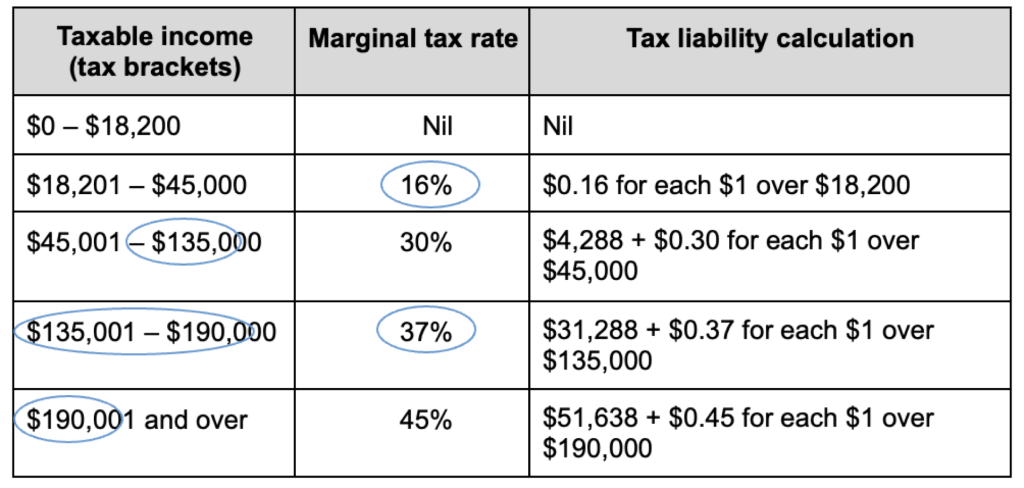

- Reduce the 19 per cent tax rate to 16 per cent

- Reduce the 32.5 per cent tax rate to 30 per cent

- Increase the threshold above which the 37 per cent tax rate applies from $120,000 to $135,000

- Increase the threshold above which the 45 per cent tax rate applies from $180,000 to $190,000.

There will be no change to the current tax-free threshold of $18,200 or the tax-free threshold of $416 on eligible income under the taxation of minors rules.

No taxpayer will pay more tax than that which would apply under the 2023–24 rates but higher income taxpayers will receive a lower tax cut than under the previous Stage 3 plan.

Taxpayers with taxable incomes up to $45,000 will benefit from a reduction of their marginal tax rate from 19 per cent to 16 per cent (maximum tax saving of $804). Under the previous Stage 3 plan, there was no change to the current (2023–24) tax bracket ($18,201 to $45,000) or marginal tax rate (19 per cent).

Middle income taxpayers will receive an extra tax cut of $804 (on top of the tax cut they would have received under the previous plan).

The benefit of the changes (in comparison to the previously legislated Stage 3 plan) cuts out at taxable incomes of approximately $147,000 — taxpayers at this income level will be $36 worse off under the changes (albeit with a saving of $3,729 from 2023–24 rates).

For taxpayers with taxable incomes of $200,000 and above, the tax cut will be worth $4,529 instead of $9,075 — i.e. the Stage 3 benefit will be cut by half.

Share